Rendre les services financiers accessibles - POSTGroup

Ensuring financial inclusion for all

Since its foundation in 1911, POST Finance has been committed to social inclusion, helping to make banking and financial services accessible to all.

A public service mission

POST Finance is the main financial institution in Luxembourg to support financial inclusion for people in precarious situations, senior citizens, social organisations, non-profit organisations, etc. For more than 110 years, POST Luxembourg has been striving to democratise access to banking services for all citizens.

Around 30,000 POST Finance clients do not have an account with other financial institutions in Luxembourg, indicating a possible vulnerability. We are reaffirming our commitment by offering them access to a bank account.”

An inclusive and transparent offer

Opening a bank account with POST Finance is open to everyone, regardless of income or means.

In the interests of transparency, POST has simplified the structure of its fee schedule, which is now just one page long and gives customers a clear idea of the options included in their package without any additional hidden charges.

Making ourselves accessible to everyone

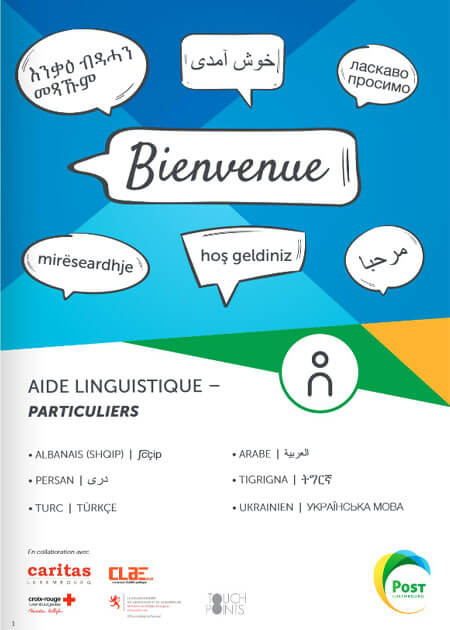

To ensure that customers receive clear information, POST provides full documentation in three languages (German, English and French) and a fee schedule in 14 languages (Luxembourgish, Portuguese, Spanish, Italian, Albanian, Croatian, Arabic, Persian, Tigrigna, Turkish and Ukrainian). In addition, the eBanking application is available in five languages (German, English, French, Luxembourgish and Portuguese), enabling our customers to manage their finances with complete confidence, whatever their preferred language.

POST's staff, who are at least quadrilingual, are on hand to listen to customers both through its forty or so points of sale throughout Luxembourg and its call centre, which is open six days a week from 7am to 8pm.

Discover our language guide

POST Finance has also worked with Caritas, CLAE, Croix Rouge, l’Office National de l’Accueil and Touch Points to roll out language support in 6 languages to make it easier to set up and manage a bank account and talk to counter staff.

An approach tailored to vulnerable customers

For vulnerable customers or those aged over 75, it is possible to benefit from a waiver of charges on banking transactions at our branches throughout the country and on paper transfers. For people with reduced mobility, certain operations, such as withdrawing or depositing money, can be carried out by the postman at home.

A personalised service to meet specific needs

ONA - National Reception Office

In collaboration with the Office National de l'Accueil (National Reception Office), POST Finance facilitates access to a bank account for applicants for international protection, with a specific account opening process has been in place since February 2022. It enables accelerated account opening, thus promoting faster integration.

CNS - National Health Fund

With the support of the Caisse Nationale de Santé, POST offers a unique service in Luxembourg: accelerated reimbursement of medical expenses in every post office and Espace POST. A unique customised service, free of charge, particularly beneficial for vulnerable people.

Working alongside business customers

In Luxembourg, the law requires banks to open a personal bank account only for private individuals. Conversely, the decision to grant a business account to an entrepreneur is at the sole discretion of the bank. Access to banking services is essential for the creation and growth of all businesses, whether SMEs, the self-employed or associations. POST Finance supports the self-employed and business founders, with the possibility of opening an account for all structures, enabling our customers to start their business simply and without delay.

Professionals, whether SMEs, the self-employed or associations, also benefit from unconditional access to an account. POST also offers the ‘Pack Club’, a reduced-price package reserved for not-for-profit associations.

Our CSR podcasts

In collaboration with Lëtzebuerger Journal, listen to podcasts on key CSR topics at POST.

Learn more

Interview with the Director of POST Finance - Paperjam

Gabriel de la Bourdonnaye, Directeur de POST Finance, points out that financial inclusion is the main purpose of the financial service.

Read the article

Contributing towards a more inclusive society

POST develops a corporate culture that promotes diversity, equal opportunities, and quality of work life for its employees.

Discover

Article in the Luxembourg Times

Banking made easy: Inclusive services with local expertise and global convenience.

Read the article